Expat Taxes: Who Pays What to Whom? Tax & Residency Issues (USA, Canada)

Learn about expat taxes for Americans and Canadians living abroad. Post is by 2 tax professionals, a CPA and an MBA in International Taxation. Plus, we share our experience while living abroad.

US Taxes For Expats: 3 Things to Know Before Retiring Abroad

Planning your retirement abroad? Here’s what you need to know about US taxes for expats living abroad. This section is by Ines Zemelman with Taxes for Expats. Full bio.

US Taxes for Expats: What You Need to Consider

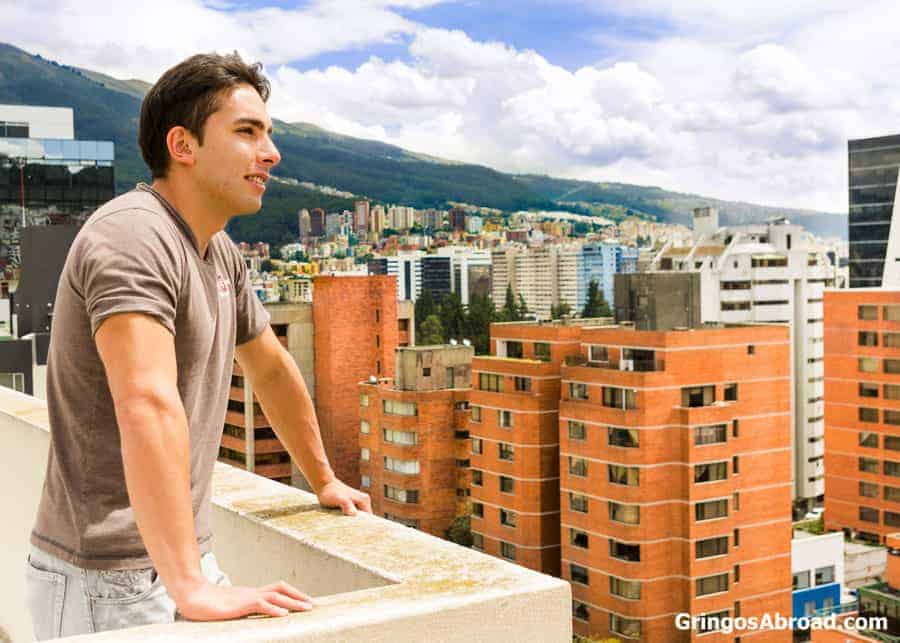

You’ve done the hard part – spent the last 30 years of your life working. Now you can enjoy your retirement, and Ecuador is an amazing place to do that.

However, although you are no longer going into an office every day, when deciding to retire abroad, you can’t lay your eyes of the ball and forget about taxation.

If you are a U.S. citizen or Green card holder, U.S. tax obligations remain, even as you are relaxing on the beach near Manta or hiking the mountains around Cuenca.

Taxes For Expats has put together a comprehensive retirement tax guide. They’ve also compiled a condensed version specifically for retirees in Ecuador – let’s look at some key tax factors to consider when planning to retire abroad.

3 Things to Know Before Retiring Abroad

1. Will My U.S. Pension & IRA withdrawals be taxed?

Distributions from a U.S. employer pension and from Traditional IRA’s will remain fully taxable by the IRS in Ecuador (or anywhere else, for that matter).

The good news – pension distributions will be exempt from U.S. state taxation. If you received those distributions while living in the US, then the state tax rate would depend on the tax rules of the state where you live upon retirement, not by the state where you earned it.

Distributions from ROTH IRA will remain non-taxable by the IRS and by your new country of residency. ROTH IRA was funded with after-tax money and therefore will never be taxed again.

2. Will I have to pay tax on my Social Security benefits?

Rules for taxation of U.S. Social Security benefits are different depending on your country of residence.

Unfortunately, Ecuador is not one of the lucky 8 and your social security benefits will be taxable (if your other income, ie dividends/interest, is above certain thresholds, see below)

Beneficiaries of the U.S. Social Security benefits residing in the following countries are exempt from U.S. tax on their Social Security benefits.

- Canada

- Egypt

- Germany

- Ireland

- Israel

- Italy (You must also be a citizen of Italy for the exemption to apply)

- Romania

- United Kingdom

If you live in any country not on this list, your U.S. Social Security will be taxable based on the same rules that if would be taxable in the U.S.

“You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000. If you file a joint return, you must pay taxes if you and your spouse have “combined income” of more than $32,000. If you are married and file a separate return, you probably will have to pay taxes on your benefits.” Source: ssa.gov

If you are a green card holder check the conditions for receiving your Social Security benefit checks.

3. Do I have to buy a US healthcare plan to avoid the ACA penalty?

If you live in Ecuador, you won’t have to buy US healthcare insurance, and you will be exempt from ACA penalties. If you move abroad and plan to stay there for an extended period, you may qualify for the Bona Fide residence status in your new country of residence.

As a Bona Fide resident of a foreign country you qualify for exemption from mandatory Healthcare coverage in the U.S.

If you already reached the Medicare age and earned Medicare benefits in the U.S., you do not have to worry about the health care exemption and may stay in the U.S. or abroad for as long as you wish with no risk of ACA penalty. However, you will not have Medicare coverage while living abroad.

If you are below Medicare age, the following may apply. If you spend part of the year abroad and part of the year in the U.S., you qualify for an exemption only for the months that you lived abroad and only if you meet the Physical Presence test. You do not need to file form 2555 to claim foreign earned income exclusion.

And there you have it: answers to three common questions about US taxes for expats in Ecuador.

Author Bio

Ines Zemelman, EA is the founder and president of Taxes For Expats, an international tax firm. With over 25 years experience, Ines leads a team of experts to help navigate U.S. tax issues for clients in 175 countries.

Do I Have to Pay US Taxes as an Expat?

In this section, you’ll learn about your tax obligations as a U.S. expat. This post is by Olivier Wagner, a Certified Public Accountant, U.S. immigrant and expat. See full bio at end of the section.

So you moved abroad. And then it hits you: “Do I have to pay U.S. taxes as an expat?”

Do I Have to Pay US Taxes as an Expat?

Just because you’ve physically left the United States doesn’t mean you’ve broken up with the IRS! America is one of only two countries in the world that keeps taxing their citizens no matter where they live or work.

The already complex process of filing your taxes gets even worse when you aren’t physically present. This leads quite a few people to wonder if they should even bother filing at all. After all, what’s the worst thing that could happen if you aren’t on your own soil? Right?

Many American expats have always been non-compliant with their taxes. They have spent their whole adult lives outside the U.S. Others figure that since they won’t be within U.S. borders, it would be impossible or impractical for the government to take any collection measures.

Citizenship-based taxation dates back to the civil war, and in many cases such assumptions were correct. At the time, the IRS had little enforcement power outside the U.S. But as FATCA is now a reality, and all your personal information is digitized, this assumption is becoming less and less valid.

Furthermore, the greater a person’s income, assets, or foreign activities (such as having foreign corporations or foreign bank accounts), the more likely a person is to be noticed and the more they will have to lose.

Both foreign corporations and foreign bank accounts come with filing requirements and potentially severe penalties for not meeting them.

You’ll learn all about these in the coming chapters. Before you decide to take this route, it’s a good idea to fully understand the consequences you might encounter if you fail to file for long enough to get caught.

The first thing to understand is that anything you owe the U.S. that you don’t pay while living overseas is subject to 3.25% interest. Though imprisonment is unlikely, you could face growing fines. Nonpayment of taxes can hurt both your finances and travel plans.

Getting Caught Up With Your US Taxes

How do expatriates become compliant with the U.S. tax system? The 1040 isn’t the only form you need to file. Many activities that seem benign can trigger specific filing requirements, and you may have to file other forms as well.

Read a book by the author: U.S. Taxes for Worldly Americans

The rules are the same for Americans living in the US, but Americans living abroad are much more likely to have participated in these “foreign” activities. They can bring about hefty fines (up to $10,000) if they’re not turned in on time.

Depending on your situation, you may also need to know about Form 5471, Form 3520, and Form 8621.

- Form 5471 must be filed if you own more than 50% of the stock of a foreign corporation (or in some cases just 10%). Constructive ownership rules apply. So, for reporting purposes, you could be considered to be owning shares which are actually owned by a related party such as a spouse or a corporation you also own.

- Form 3520 is pertinent if you are the grantor or “substantial owner” of a foreign trust. While the word “trust” brings up the idea of wealthy families, the U.S. tax rules see products such as the Canadian RESP (similar to a U.S. 529 plan) or foreign retirement plans (similar to a 401(k)) as foreign trusts.

- Form 8621 is for people who own stock in a Passive Foreign Investment Company (PFIC). In many cases, foreign mutual funds would also be classified as PFIC.

My Tax Advice for US Expats

My advice to everyone who does not already file is simple: you have a lot more to lose by not filing than by getting caught up with your taxes.

You may not have to face the consequences of it today or tomorrow, but the longer you go without paying your legal dues, the more likely it is that it will eventually come back to bite you (and the worse the bite will be when it happens).

Most people owe a lot less than they think they do, and getting compliant can be a much easier process than they assume.

There are many options for going from tax non-compliance to compliance.

While many people today rely on the IRS’ standard interview process to file yearly, I hope to show you that it pays to go over everything with a fine-tooth comb and take advantage of every policy at your disposal when you file.

Tax preparation software like TurboTax can certainly be useful for organizing your information, but one should always review the actual forms before filing. It’s a lot to keep in mind, but drastically easier once you know what you are dealing with or have a professional who knows the unique territory you are traversing.

About the Author: Certified Public Accountant, U.S. immigrant, expat, and perpetual traveler Olivier Wagner preaches the philosophy of being a worldly American.

In his new book, U.S. Taxes for Worldly Americans, he uses his expertise to show you how to use 100% legal strategies (beyond traditionally maligned “tax havens”) to keep your income and assets safe from the IRS.

Have a question about your expat tax obligations? Or maybe a tip or resource? Join us in the comments!

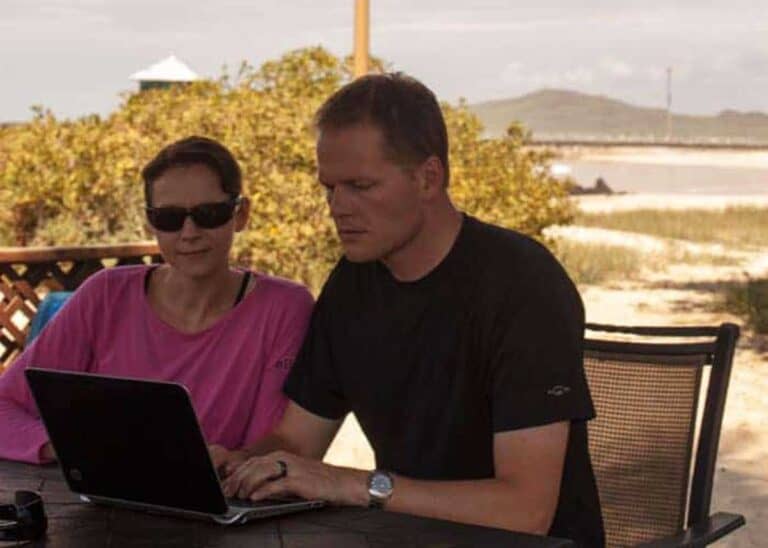

Our Tax and Residency Issues as Canadians Abroad

Moving abroad can be a romantic thought. A new culture and a new language. Different foods and new friends.

Moving abroad also opens up a new set of legal and tax requirements both in your home country and in your new one.

When we first moved to Ecuador, our family was on a temporary visa that needed to be renewed every two years. At the end of our first two years in Ecuador we decided to apply for a permanent visa which would give us permanent residency. This visa does not need to be renewed or apply for again – thus the word “permanent”.

When we first moved to Ecuador, we submitted a request for determination of residency status to the Canadian government to make sure that we were fulfilling our tax obligations. As we were deemed to be non-resident in Ecuador the Canadian government then deemed us Canadian residents, as we needed to be residents somewhere.

As a result, the Canadian government decided that we still qualified for certain benefits, including the child tax benefit which we received up until we got permanent residency here in Ecuador. Just a few weeks after we received permanent residency last March, we again sent the request to the Canadian government for determination of residency status. The form in Canada is known as the NR73.

This four-page extremely-detailed form helps the International Tax Services Office in Ottawa determine what our status and thus our obligations in Canada will be.

Of course, they ask questions such as where home is, where the majority of our belongings are, if we continue to have Canadian health insurance, etc. But they also cover things such as investments remaining Canada, mailing addresses (like a PO Box), magazine and newspaper subscriptions, and even the type of cell phones that we have here in Ecuador.

The issue that seems to be confusing our request the most, is that we continue to own a Canadian business.

Because all of our work is done online, almost everything we earn is billed through our Canadian company. Until now, we have only paid tax in Canada – but our new residency status in Ecuador is calling that into question.

I have been waiting for our Canadian ruling before I speak with tax lawyers here in Ecuador (to determine what our tax requirements will be) because the first question that they are going to ask is: “What’s your status in Canada?”

Since sending the initial request for the determination of residency status, we have sent a clarification letter and spoken with them by phone many times. After almost one year of waiting, I’m told that we should expect something later this month.

Why Go Through Hassle of a Determination of Residency Status?

We could make a self-determination, but if it was wrong we could be looking at a humongous tax bill including penalties, fees, and interest.

For me, the legal ruling will give me peace of mind, knowing that when I return to Canada they won’t arrest me and put me in prison for tax evasion. Worst case, of course – but who wants to deal with that on a vacation home…

A Surprise Tax Bill from the Canadian Government

Shortly after sending in the initial request for determination, we received a bill from the Canadian government for almost $8000. When I called them to clarify, they told me that this was an automatic letter/bill that doesn’t need to be paid or even worried about until the determination/ruling is made.

Apparently, as soon as an individual’s residency status is called into question, everything is put on hold – and past payments are requested – all automatically by their system. So for the past 10 months, we have been nervously awaiting the ruling.

So while we await the ruling from the International Tax Services Office, I thought I would share our little story with you – to help you know what to expect when you go through it.

Residency: Isn’t That Where I Live?

The issue of residency is an interesting one. While you may say that you reside in a certain city or country, that doesn’t mean that you’re a resident there. At least not according to the government.

From what I’ve learned during this process there are (at least) three types of residents:

- actual/factual resident

- legal resident

- deemed resident

So for our first two years in Ecuador, we were actual residents, because we lived here – but deemed residents in Canada because we had a temporary non-resident visa in Ecuador. Meaning that while we actually lived in Ecuador all of our legal and tax responsibilities were to Canada.

And while we are now legal residents (and actual) in Ecuador, the Canadian government has told me that we may be deemed residents in Canada as well. This means that we may retain certain benefits and also tax obligations back home.

If you sort it out fairly quickly, this isn’t something to worry about. If you’re receiving benefits from your home country and your legal status has changed, you may not be eligible for them anymore. The best-case scenario is they will simply ask for repayment of the benefits when they find out. Worst-case scenario, well… let’s not go there.

What has been your experience with residency and expat tax issues?

We Have Residency In Ecuador! (What You Should Know)

We Finally Have Ecuador Residency! We wanted to get residency here in Ecuador, so we started the process last April. It took a long time to complete all the steps (11 months) but now we have it!

Don’t let the 11-month thing scare you. We were caught in the midst of some changing laws, and we changed our minds partway through.

We had started the process wanting to establish a corporation but as we got deeper into the creation of it we realized that it was way too involved and decided to pull the plug. That cost us a lot of time and gave us a lot of headaches.

After we decided to shift gears we went with the investment option, and we now have residency based on that.

We needed to travel back to Canada to get police reports, and we also had to travel out of the country again (Miami) in order to re-enter on a tourist visa because the visa we were on was running out.

The tourist visa bought us the time we needed to finish the residency process.

Are You Thinking About Getting Residency in Ecuador?

If you want to get residency in Ecuador make sure you know what paperwork you need before you start the process.

You can find out all the ins and outs of what is required by contacting the Ecuadorian consulate in your area before you come. You should also meet with lawyers on your initial visit here in Ecuador.

Things can get confusing and frustrating during the process for 3 main reasons.

1. The Laws Sometimes Change.

This leaves lawyers scrambling in order to help their clients in the most timely manner possible. They may tell you one thing about a certain requirement and while you are working on it, call and tell you something entirely different about that same requirement.

This is not their fault, they can only work within the parameters of what the government requirements are, and these are subject to change. If you find this frustrating, don’t take it out on the lawyers, they don’t make the laws – they just try to help us work within them.

2. The Language.

Even when we Gringos think we understand everything, we often don’t. This is most often due to things getting lost in translation. This is not our fault or the fault of the Spanish speakers we are dealing with, it’s just a fact of life in a foreign country.

Language is a tricky thing. What we have learned is to keep asking questions until we are completely clear on what the next steps are, and then we repeat back what we think we understand just to make sure we actually get it right.

3. Incorrect Information.

You may receive incorrect information from other expats because the laws have changed since they got their residency and no longer hold true for your experience. That’s why we do not give out specific details about our residency process or requirements.

Another reason may be because your expat friends are passing on information from people who may have misunderstood the process or given wrong information to their lawyers – which would have caused a problem in their process.

This could lead to all kinds of problems, that’s why it’s always best to go directly to the source: Trustworthy Ecuadorian lawyers. If you need help with the legal stuff you could contact the lawyers we used, our friends Nelson and Grace.

Remember this!

The most important thing we needed to remember was to be patient and stay calm. Getting upset with government officials would not have helped us get what we wanted, and it probably would have given us a bad reputation.

The process could also have been slowed down so much that we would have been unable to complete it in the given time frame.

We found it best to always assume that we had made a mistake or misunderstood something.

Being apologetic usually caused the people trying to help us to feel sorry for us and made them want to help us more. In almost every case, we had made a mistake or misunderstood what we were supposed to do next.

I think if we had approached the process with an “now, I’m going to set these people straight!” attitude, we would have received the same type of attitude in response. That would have just been an ugly mess waiting to happen.

Avoiding a Gringo Superiority Complex.

The government and their employees work differently here than in the States or Canada. Things take longer and are subject to change, but if you want something done that involves the government you have no choice but to work with it. Things will work out, but patience will be required.

It’s all worth it in the end! We feel like we can really make this our home now 🙂

Your Turn

Have a question? Or maybe a tip to share for other expats? Join us in the comments!

Hello!! That info was great! I am so glad I found you on here. I am in need of your help. I lived in Ecuador (Cuenca) for almost 4 years. I am now building a business on the land outside of Quito. I am a retired police Sgt and I don’t know business, never mind international business. I very much need to connect with a knowledgeable accountant and lawyer (poss Nelson and Grace) to learn all I can to make initial decisions. Might we connect to either ask questions or even take you on, if willing?

Tara

whatts app 401-203-6246

Hello,

Thanks for the detail of your story.

I am curious what your ruling was as I am in a similar situation.

I will be moving out of canada (with my spouse and children) for about 5 years due to my husband work (non canadian company).

I have a house, active bank accounts, investment accounts, business accounts, valid drivers, Canadian passport, car, furitures in Canada.

The CRA still gives me CCB even though I called and asked them to stop payment, as they say it is tied to my residency. And they cannot be sure my residency without filing NR73.

So I wanted to know in your opinion will I be consider a non-resident? How long did it end up taking to get a ruling?

Thank you,

Selena

A specific question: As a US citizen earning income exclusively from a US corporation and minimal EC bank interest as a permanent EC resident is this correct?

My worldwide income (all from a US corporation) is taxable in the US, but subject to exclusion as a permanent EC resident. This includes EC bank interest.

As an EC resident, that same income is subject to EC income tax.

That EC income tax can be taken as an itemized deduction or tax credit (the latter being more beneficial).

Since not working for an EC company, how is EC social security handled, if at all?

If you are on a SS widow’s benefit that will transfer to a retirement benefit in 1 & 1/2 yrs, are you able to move to Ecuador and get residency status, continue to collect the SS widow’s or retirement benefit permanently, without having to return to the US every 6 months?

Please remember Ecuador does NOT have a tax treaty with the US. Therefore, any income earned in Ecuador, by a US citizen, in excess of the US foreign income tax exclusion (approximately 100k for 2015 assuming you qualify) would be subject to tax in Ecuador AND the US.

Hola Bryan!

I’ve been following your blog for about a year from the U.S. Well, here I am, I arrived in Cuenca, Ecuador the day before yesterday and will be applying for a pensioners residency visa.

Thanks for the awesome blog!

Paul

Congratulations and welcome!

Hi Bryan,

I am curious as to what Canada will rule regarding your residency status. I have been considering moving abroad for a while, so I asked a few questions to my accountant, but it is still pretty confusing. My situation seems to be similar to yours. I am a self-employed translator and all my clients are in Canada, except two for which I do maybe one job a year, not even. Given that I intend to keep my bank accounts (especially the business one) here in Canada, as well as credit cards and RSPs, I am pretty sure I would be deemed a resident for tax purposes, at least until I decide to leave permanently, so I expect to pay Canadian income tax, but what about the provincial income tax?. Did you have to pay provincial taxes as well, or just the federal portion? What about HST? Did you continue charging it on the products/services your company sold? And what if down the road, I live in Ecuador full time, from the info you gathered, do you think I would have to pay taxes in Ecuador if all my income comes from another country? The tax rates in Ecuador seem pretty high judging by what people have posted here. I am considering moving to Ecuador to enjoy the lower cost of living, so I don’t want to end up with a higher tax bill.

Thanks.

Hello Brian. Man I read numerous comments regarding income tax . I am thinking wow! Brian has to come up with a reasonable answer that makes sense to these good people. A job i will continue to let you do. i will keep my job.

OK I may have an answer for some folks. It is a short version of what worked for one “Old Gent” that I personally knew.

He worked nearly all his life with the exception of the first 4 or 5 years that he was in the work force. This man never made out income tax papers of any description in his entire life while working. When he became 24 or 5 he built a building for himself and started up a small business. it proved to work for him. he ran that business until he turned 65 , all this while no income tax papers of any kind.

Now he is 65 and wants his “Old Age Pension ” . The Federal Government says who are you, you don’t exist . He had a very hard time to prove he did exist . After a year he finally Got His pension coming. Went his whole life without paying taxes. Maybe that is the simplified version to some Folks

Thanks for an interesting article Bryan! I am curious to confirm your understanding of whether your Canadian sourced income could be taxed by the Ecuadorian government? I have seen contradictory information online on this point, and cant seem to find relevant info on the SRI website. Similar to you, I do web-based virtual work, where I am physically located in Ecuador, but am legally employed and paid exclusively in the US. I received residency in Ecuador just a few months ago. I’d love to hear your understanding on this point, as well as any recommendations on good tax lawyers in Cuenca who are familiar with these type of international situations, and who I could seek out for a professional opinion.

My understanding is that revenue earned outside of Ecuador isn’t taxed in Ecuador – as long as there is a tax treaty between the two countries. There are tax lawyers in Cuenca, but the names escape me. You can check with Grace and Nelson (our lawyers in Cuenca) for their recommendation. Maybe you can share that info here after?

Thanks Bryan! I actually spoke to a lawyer this past Friday. Their guidance was consistent with what you said. In my case, despite my residency in Ecuador, my work/pay is entirely outside of Ecuador. This income is not taxed in Ecuador, but in the country where it is generated/paid, as may be relevant with their legal structure. He did say, however, that this is not a fully generalizable principle– there could be situations in which a business or individual could have different obligations than mine own. For that reason I would recommend any reader here make sure to directly discuss their personal situation with a lawyer.

Nice. Thanks for the update. Agreed that it’s always better to speak with a lawyer. Do you have their contact information?

I actually spoke with Nelson– I had previously met him through a friend and had gotten some legal advice from him on another topic. Nelson is very knowledgeable and a great guy– I would recommend him to anyone with similar questions.

I try to pay my taxes exclusively in Canada to keep things simple (with client work in several countries… in the US there is the “theoretical” state tax as well, but no business traveler seriously complies… 20 separate state tax return filings in any given year anyone?). An investigation by a Global Mobility expert from Deloitte that my employer hired to find out for me concluded that I could not be taxed in any way in Ecuador as long as I did not spend more than 6 months in the country in any rolling 12 month period.

Good info. I am an American who has lived in Salinas since 2007. Life is good en EC. Enjoyed your insights on the Galapagos too! d

Thanks Donna! We really enjoy Salinas for vacation.

Bryan

I have a situation and I need some help . I’m an Ecuadorian /American and I’m planning to open a business in Ecuador and moving there . my question is where do I need to pay my taxes now? or do I have doble taxation. thanks for your help

That’s a good question. You should speak to a tax attorney in the US and in Ecuador. Everyone has opinions, but I think you should get an experts point of view.

U.S. citizens are required to pay taxes on all worldwide income of any kind: wages, alimony, interest, rental income, you name it. However, if you pay taxes on income earned in a different country, the IRS allows you to deduct the tax paid to the other country, dollar for dollar. Also, if you are a U.S. citizen working outside of the U.S. and earning income, and you have been out of the U.S. for 330 days in ANY 365 day period that overlaps any part of the taxable year, you can deduct up to $97,600 (in 2012) of income earned in that taxable year. Non U.S. citizens earning income in the U.S. are required to file a tax return in the U.S. and declare all U.S. earned income; but non U.S. citizens, earning income elsewhere than the U.S., are not required to file a tax return UNLESS income is earned in the U.S>

Thanks Sarah, very helpful information!

If you are a U.S. Citizen, you must file your tax return annually (usually due April 15) declaring ALL worldwide income. You may or may not have to pay any tax, depending on a number of items you may deduct (see my other comment below). I don’t know anything about Ecuadorian taxes, but, as a U.S. citizen, even if you have dual citizenship, you can deduct any tax paid to Ecuador from your U.S. tax return, dollar for dollar, and if you’ve been residing here (see the date/details below) you can also deduct income up to the $$ amount I listed for 2012, due to foreign residence status. The main thing: file your taxes. This can be done online, or ask a tax professional to help with the details. Good luck with your business venture here in Ecuador!

I have residency in Ecuador, I am Canadian and make my living as a contractor for U.S. paying customers. Anyone know for certain where I would pay my taxes?

That is exactly my situation, except that I travel in and out since I visit my customers in the US and in Canada, so I have been staying in Ecuador on a tourist visa. I maintain a home in Canada. I pay my taxes in Canada only. Due to the tax treaty between Canada and US I do not have to pay taxes in the US. I wonder myself if anything would change if I actually got permanent residency in Ecuador. My plan is to maintain ties with Canada even when I get residency in Ecuador, so that CRA keeps taxing me as a deemed resident and I keep paying taxes on my non-Ecuadorian income in Canada only. I will let everybody know if I succeed, but I believe Bryan and Dena are very close to getting a CRA decision on a similar thing.

When working in the US it is a balancing act. The IRS has you on the hook if you spend too much time there physically. However, I get off the hook by maintaining closer ties with Canada and I can choose to pay my taxes there. If you derive income from US sources, but are not physically there, I believe you can either choose to pay a flat tax or file a form with the IRS to exempt you from taxes on the grounds of paying taxes in your country of residence. I could imagine that there are also variations on how you define US sources. If you have a company in the US, that would be US sources. If you provide services in the US as a Canadian company based on NAFTA Appendix 1603.A or similar then your situation would match mine and you could opt for paying taxes in Canada if your ties with Canada are closer.

So if I am an English citizen, but been a resident of the US for 40 years, after I become a resident of Ecuador, which country am I beholding to for tax liability? Still the US?

As long as you are not a US citizen you cease to pay tax in the US when you leave the US. If you are a permanent resident of Ecuador you would pay tax in Ecuador only as an English citizen.

Thanks, Jakob, this is great news.

Sorry, one more question. After I moved to Cuenca, I will be able to work for a US company in Ecuador through the internet. When I become a permanent resident of Ecuador, with English citizenship, do I pay taxes to Ecuador (which is where I live when I earn the money), to the US as the company is based in US, or even England, my citizen country? Thanks once more, Jakob.

You have not lived in England for many years, so England will let you off the hook (unless you spent significant amounts of time there every year). Much depends on your status as a worker. In Canada we call it Employment of Service vs Employment for Service, in other words are you a regular employee of the US company with a US based salary in US$? Are you a contractor? If you are a contractor, do you bill as a domestic or as a foreign business in the US? If you want to bill as a foreign business you would probably register a business in Ecuador and provide services to the US. Then you would pay taxes in Ecuador. If you were a regular employee of the US company with a US based salary, then you would pay taxes in the US. We have a regular employee who lives in Mexico, but receives a US based salary into her US bank account. She has to pay taxes in the US. It even went as far as US authorities demanding she provide a US address as they were irritated at the fact that she was employed in the US, but did not live there (it was also a work visa issue as she is a Mexican citizen). She rented a small apartment in Texas just for that, but she is never there.

Jakob said “As long as you are not a US citizen you cease to pay tax in the US when you leave the US”. This is incorrect. This only applies when you are neither US citizen nor US permanent resident (popularly known as “green card holder”). I suspect Lorraine, having lived in the US for 40 years, is likely a US permanent resident. If this is the case, US tax liability can only be eliminated if the PR status is renounced.

I don’t know the US system, but in Canada you automatically lose permanent residency when you become a permanent resident of another country. Canada doesn’t allow for you to be a legal resident of two countries. Is it different in the United States?

Bryan, there must be millions of people who hold US green cards but live elsewhere. They only need to enter the US once every 6 months to keep the green card. Canada is getting stricter over the years on residency requirements for Canadian PRs, but some countries in the world have very lenient requirements (including quite a few in Central and South America), so it is in practice very easy to hold Canadian and another PR at the same time.

I’m not sure where you heard this, but it is not easy (or even possible) to be a permanent resident of Canada and another country at the same time. Give the International Tax Services office a call and they’ll explain. The whole concept of permanent residency is to identify where you reside permanently. Travelers and expats must have one – at least according to Canadian tax law.

Moreover, you don’t lose US PR automatically; you need to specifically go to the US embassy or consulate in your country of residence and expressly renounce it. Failing that your tax liability remains. Also, Bryan, I don’t think Canadian PR “automatically” lose it when they become PR of another country. Even if there is such a rule (I highly doubt it), it can’t be enforced since countries don’t inform one another an individual’s newly acquired PR status. I personally know a few people who have both Canadian and Australian/ NZ PR (they are UK, Indian and Chinese citizens).

While it isn’t criminal, there are tax implications to not informing your government of your change of residency status. From my experience, the Canadian government considers you a non-resident for tax purposes when you become a permanent resident of another country.

When I said “leave the US” I meant leave permanently implying that you would not be a Permanent Resident (i.e. Green Card holder), I wasn’t clear enough.

With Canadian Permanent Residency, when I was a Canadian PR before becoming a citizen, I got the explicit question several times from Canadian authorities whether I was a Green Card holder. CIC explained to me that it was not possible to legally be a Canadian Permanent Resident and a Green Card holder at the same time. Had I answered with “yes” they would have started a revocation process of my Canadian PR. This means, John, that your friends get to keep their Canadian PR as long as nobody finds out about their dual status, once they get asked that question they’re done. However, they can still be citizens of another country in which case CIC will only look at the Residency Obligation and whether it is being complied with.

Maybe I missed something, but I thought that if I combined the federal and BC income tax on my pension, I come up with about 20% ….. so as a resident of ecuador, I pay 25%? A bit of an increase, but the cost of living outweighs the extra tax. Plus, I was not aware that our medical plan in Canada was free …. seems to me that there is a monthly fee, and let’s not talk about the waiting times to get anything done.

I think you only need to worry about income tax in Ecuador if you earn money here. As I understand it, you’ll be responsible for paying Canadian tax on income earned (received) there.

Ed… Canada charges a flat 25% tax on income from Canadian sources if you are NOT a Canadian resident. Whether you are taxed as a non-resident or not depends on how CRA classifies you. If you are taxed as a Canadian resident then you will keep your current 20% on your Canadian pension.

Curious to know have you met any Canadian retirees with Canadian non-resident status in Ecuador? My understanding is that once you are non-resident you are then subject to 25% flat tax with-held from Canadian source income such as your company pension, CPP, RRIF and RRSP withdrawls. I’m thinking if we stayed in Canada we would pay almost no tax with only a small pension as income. We would like to retire early in Ecuador and live on RRSPs until the pensions kick in but not if 25% comes right off the top. The tax situation could be better by keeping the resident connection to Canada but I don’t want to have to split the year going back and forth like a lot of snowbirds do between Canada and the States. Hopefully just keeping an apartment and bank accounts in Canada is enough to keep resident status. Lots more to look in to before any big move; I need to know before we go. Looking forward to more info. Thanks for the Blog. We took our teens through Ecuador in 2011 (Quito, Banos, Otavalo, Cotacachi, Puerto Lopez) and loved it. Hope to be there again soon.

Janine, you should be able to file as deemed resident as long as you have some ties to Canada (bank account, real estate, family). As far as I know it is harder to convince the CRA to let you file as non-resident than vice versa, I think you have to be approved as a non-resident first after serving ties, so if that does not happen you should not have problems to file as deemed resident. The easiest would be to call the CRA hotline and ask anonymously. I have done so many times.

No one has said what the taxes are in Ecuador. I file my Calif and Federal Taxes each year and my income is so low I don’t owe taxes. It would be nice to earn more than $90,000 a year again to have to worry about paying US taxes.

I can’t find the requirements to file for a permanent Visa, anyone know?

I am planning on relocating to Ecuador later this year. I have an income of just under $2000.00 per month from SS retirement. I am single and hope that will suffice. I file taxes each year but never owe anything. I am now a resident of Oregon and pay no taxes here either but do file just to cover my Ass. When I move to Ecuador I will use my mail forwarding address in Texas. Do you know if any tax issues will change?

Do expats have their checks deposited to their bank in the US and then access through debit or transfers or ? Thank you

John

If your address becomes one in Texas, effectively, your residency in the US will be in Texas. There is no state tax in Texas! You should no longer be required to file in Oregon; the last partial year you reside in Oregon I suggest filing a “partial year resident” income tax for Oregon and they you will be dropped off of their tax roles. An easy and inexpensive way to receive funds from US banks is to have your SS checks deposited in the US, obtain a bank account in Ecuador; write yourself a check for funds from the US bank once a month and deposit that check in your EC bank. In about 3 to 4 weeks, your funds will land in the EC account for your use. No wiring or US bank debit card charges, but you do need to wait a bit more than using the ATM.

I mainly use my ATM cards to pull money in Ecuador. I find the big banks’ ATMs in Ecuador honour even high daily withdrawal limits on foreign accounts (Ecuadorians rarely get more than $300), but the ATM’s physical limit will be $500 per transaction. Some foreign banks’ ATM cards do not work with some of the banks’ ATMs in Ecuador, but there are always several that will. With cheques check your Ecuadorian bank’s policy. Mine refused to cash a US$ cheque from myself to myself saying they did not accept foreign cheques. I do know that quite a few banks in Ecuador seem to allow that. Wire transfer works for larger amounts, but comes with a price tag (charged on the send and the receive end) and a lot of banks in North America require you to come in personally for the wire, so unpractical if you are already in Ecuador.

We just opened an account at Pichincha bank and they accepted both a US bank check and a US credit union check. They didn’t really say how long we will need to wait for the funds to be available with our new Pichincha ATM cards, but we figure several weeks.

Jakob,

Which banks allow up to a $500 withdrawal or even a $300 withdrawal on a US account? We were there in August and we could only get $100 out at a time. Since we had tried to get $300 from one bank and then got locked out, we went to another bank and got $100, then another bank for $200. One of these banks was only in Spanish too and we didn’t know what the choices were, we cancelled the transaction. Then our CC company thought our card was stolen and locked the card. We could avoid all this the next time we come if we know what bank ATM to go to that allows a higher limit. Could we go inside the bank and get money from our CC at the window?

Thanks,

LC

We have withdrawn these amounts from both Banco de Guayaquil and Banco Pichincha on our US accounts. It could be an issue with your home bank, not the banks here. Some travelers advise their home bank that they’ll be traveling abroad so that blocks don’t get put on their accounts. We’ve found Banco Pichincha to be the most reliable.

Banco de Guayaquil used to give me $1000 a pop (2 back to back withdrawals of $500 due the technical ATM slot capacity limit) with my Canadian card, but they recently reduced that to $300 per day. They also charge $1.50 per withdrawal, so I stopped using them.

Banco de Pichincha does not work with my Canadian ATM card, but it works with my US Visa debit card up to my $750 daily withdrawal limit that I have on that account (again, there is the technical ATM slot capacity limit of $500, so I have to withdraw twice). It’s also free to withdraw with Banco de Pichincha for me.

Banco de Pacifico works with both, my Canadian and my US cards, charges $0.50 per withdrawal and can do up to $600 daily (imposed by Banco del Pacifico, my accounts State and Canadian side could do more). The technical ATM slot limit is also $600 on their machines, so I do one pop of $600 daily with them.

Banks that do NOT work for me at all ATM wise: Banco Internacional, Banco Bolivariano and several other smaller banks.

I am currently building a house, so I have been hitting these limits a lot recently using several cards at each ATM. I might even have been the single reason that Banco de Guayaquil reduced their ATM limits 😉

US and Canadian banks do track your movement and behaviour patterns patterns for fraud prevention purposes. Funny enough I get called by my bank to confirm when there is a withdrawal on my account at an ATM in Virginia, but Ecuador does not raise an eyebrow for them. That goes to show what they know about me, they probably also know whether I am right or left handed and who I go to bed with at night (or maybe they just call the NSA), but if you want to be sure not to trigger fraud alarm call them and tell them you will be in Ecuador for a while.

Bryan; read your comments on the taxes. Wow! do you realize if you had not taken the liberty to call about that tax bill of a cool 9000.00 and paid it. You could have kissed your money good by.Thanks to quick thinking on your part, you folks saved 9000.00 bucks. Keep on you toes at all times. I have made some blunders in my day and it cost me money. live and learn, still holds true Bryan. Chow for now Lou.

Jakob is correct, but Eritrea and Finland also have taxation rules similar to that of the US, taxing all income of citizens no matter where they live. And yes, any foreign tax that is paid by a US citizen, is considered a credit on any US tax the US citizen taxpayer may owe. The US doesn’t care where you live, you must file a tax return as a citizen. However, if you live/stay abroad for at least 330 days during any period (that may encompass more than 1 tax year and does not have to be continuous) a US citizen can claim an exemption of a foreign earned income up to the amount of $95,100 (for 2012)and not owe tax on that exempted amount. All income earned anywhere in the world is required to be declared to the IRS if you are a US citizen. By the way, I work for H & R Block in San Antonio, and I do a brisk amount of tax returns for US citizen expatriates all over the world who can file their taxes by doing what we call an “Online Approval” where, after email conversations and receipt of the emailed documents, I ship the tax return to a secure spot, an email is sent to the taxpayer, a different email with a pin number to access the file; the taxpayer reviews the online tax return, pays for the return, it comes back to me as “ready to file” and I electronically file the tax return to the IRS. Email me @ sarah.canez@tax.hrblock.com and I’d be glad to give advice to any US expats.

Bryan… This situation is coming at me in big steps. It also means that I have to give permanent residency in Ecuador one hard thought. It might be more advantageous to not question being considered resident in Canada if my income is largely derived from there. You also mentioned benefit eligibility. I realize that for most people permanent residency gives stability. In my case, with my wife being Ecuadorian, I am wondering whether there is an advantage for me in getting Ecuadorian residency at all as long as I do not have an actual job in Ecuador.

It is a good question. From the conversations I’ve had with a number of people from the Tax Services Office, they all indicated that we will continue with Canadian benefits because of our ties in Canada. But the ruling is the only way to go – so we don’t have trouble in the future. We are actually hoping for a “deemed resident” status with Canada – so we can continue to pay taxes there and I can avoid learning a whole new tax system (in Spanish).

Your situation is different because a permanent residency status in Ecuador was the only way we could stay here long term – it appears to be different for you as your wife is a citizen. I’m curious to know what you decide and how it works out for you. This is all new for me.

For incomes under $10k a year it probably does not matter so much. However, there are some professionals I have known in Ecuador since they graduated from university whose salaries have exploded in the last 5 years from a couple hundred dollars a month to something that is similar to what we pay Canadian university graduates at our Ontario office (signs of a fast growing economy). The tax system assumes lower salaries to be the norm and is not as quick to adapt. In direct comparison I know that you end up paying a much lower tax on the same income in Canada vs Ecuador if you are professional grade. A friend of mine named all the different taxes he is deducted from his salary, including special taxes on “professionals” (i.e. people with a degree) and it is more convoluted than in Canada, almost like in Europe. If you ever get to the six digits the difference would really hurt, but I have to yet see that for a regular employee in Ecuador. This is why I’d rather not be taxed in Ecuador.

Interesting. Thanks for sharing this Jakob.

I took a deeper look at the web page of the SRI (Servicio de las Rentas Internas) as somebody posted that nobody had said what the actual taxes in Ecuador were. All the information is there, but it may be hard to put 2 and 2 together. The system reminds me of Germany where the government keeps telling the people that the tax rate is not that high in international comparison, but they don’t mention that it is because social insurance (such as health care and retirement) are separate mandatory deductions not included in regular tax (unlike health care in Ontario) and they are equally high.

Anyway, the basic table for salary deductions at the source (impuesto de la renta) 2013 seems to be capped at 35%. Looks better than Canada at first glance:

Año 2013 – En dólares

Fracción Básica Exceso Hasta Impuesto Fracción Básica Impuesto Fracción Excedente

– 10.180 – 0%

10.180 12.970 – 5%

12.970 16.220 140 10%

16.220 19.470 465 12%

19.470 38.930 855 15%

38.930 58.390 3.774 20%

58.390 77.870 7.666 25%

77.870 103.810 12.536 30%

103.810 En adelante 20.318 35%

In addition to this the “professional” tax is 10% and applies to self-employed people providing professional services in general (not just people with degrees as I originally thought). It is charged when you invoice your customer (sort of like GST), but in Ecuador consumer prices include all taxes (European style), so a hike on this tax actually takes a chunk of your income if you don’t raise your rate.

On top of this, regular employees are affiliated with the IESS (social insurance, something like EI and CPP, but including health insurance which is tax financed in most provinces in Canada). Do you remember the discussion about how domestic workers now had to be affiliated with the IESS by their employers? That contribution is split between employer and employee (this is European style as well) and the employee portion oscillates between 9.35% and 11.15% depending on the sector you are employed in. If you are self employed and want the benefits of social insurance you pay 17.5% of your income.

So, a self employed person who is part of the public social system would pay 10% + 17.5% + whatever rate applies according to the table above which can quickly add up to half your income.

A dependent employee only pays the 9 – 11% IESS and the tax according to the table which is somewhat less.

We gringos do not have to be part of the IESS and we usually derive our income not from professional services inside Ecuador, so essentially that would leave the tax table only which is better than I assumed. It roughly corresponds to what I am paying in Canada as well. However, in Canada I also get free health care and a pension plan with that.

Thanks for this Jakob – this is great info. I’ve been meaning to do this, but dreading it at the same time.

Bryan

Another tidbit of information from the SRI web page:

“Los ingresos obtenidos por personas naturales que no tengan residencia en el país, por servicios ocasionalmente prestados en el Ecuador, pagarán la tarifa única del 23% sobre la totalidad del ingreso percibido para el año 2012.”

This means that the non-resident tax on income from Ecuador sources is a 23% flat tax. The same tax is 25% in Canada as somebody already mentioned in one of the recent posts.

Thanks for all your good insights, Bryan. And thanks to Jakob, too.

Can either of you recommend one or more Ecuadorian tax lawyers? I’m physically near Cotacachi, not Cuenca.

I have the name of a firm here in Cuenca – but I don’t have any contacts in the northern part of Ecuador.

….I’m a LITTLE frustrated (though learning how to live on Ecuador time !!)

It’s been several weeks, yet I’ve yet to receive a cogent response from the Houston (U.S.) consulate on the question…can I apply for immigrant visa) status while I’m in the USA? My understanding is that … recently… “rules” have changed, requiring a local “abrigado” to have POA for the process. True??

Good question. I know some other readers are back in the US waiting for their visa approvals. And I know that you can apply for residency without a lawyer. But it would be very challenging to apply for residency from the US without a lawyer. If you are in the US, you should check with a lawyer to find out how it works with them. Or if you are here, you can either choose lawyer or apply on your own. I don’t know about recent changes…

From what I understand the U.S. taxes on worldwide income, so yes, you will be taxed.

Thanks for posting Bryan. Very helpful.

This is a question a lot of Americans like myself would like to see answered, if living in Ecuador, do we still have to pay tax to the US even on income earned outside the US? Dom

Dom… The US is the only industrialized country I know that taxes by citizenship. If you are an American citizen you have to declare no matter where you live. There are numerous tax treaties though to prevent double taxation, so you indicate your foreign taxes paid and the IRS will honour them. I have filed in several countries the for the same year before and it was not as bad as I had thought.

Most other countries do not tax you if you do not reside there. In the case of Canada you have to apply for being considered non-resident. In the case of Germany it is as simple as going to your local administration and officially unregistering yourself with a note that you are moving abroad. In the case of Ecuador (in case you wanted the Ecuadorian citizenship) they will take note of your departure at the border or at the airport and you are off the hook until you come back and start making money while in Ecuador.

Cheers.

Jakob

Domenick

As of the end of 2012, the US law was you could make up to 90K in a foriegn country before having to pay US tax if you were a resident of that country.